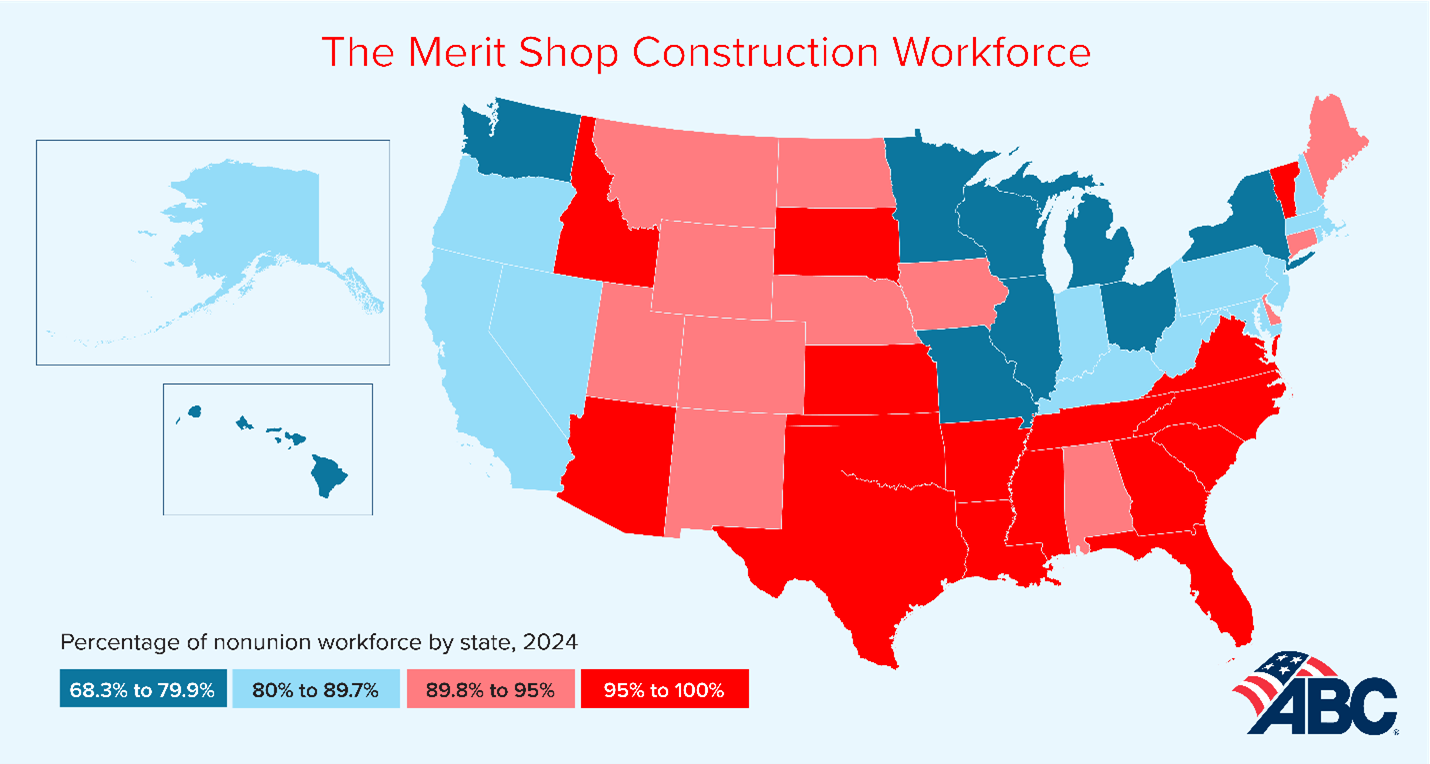

Associated Builders and Contractors has released an analysis of 2024 state union membership data published by unionstats.com, which found that in 41 states at least 80% of workers in the private construction industry did not belong to a union.

Massachusetts was among those states, with 80.4% percent of the construction workforce choosing not to join a union in 2024.

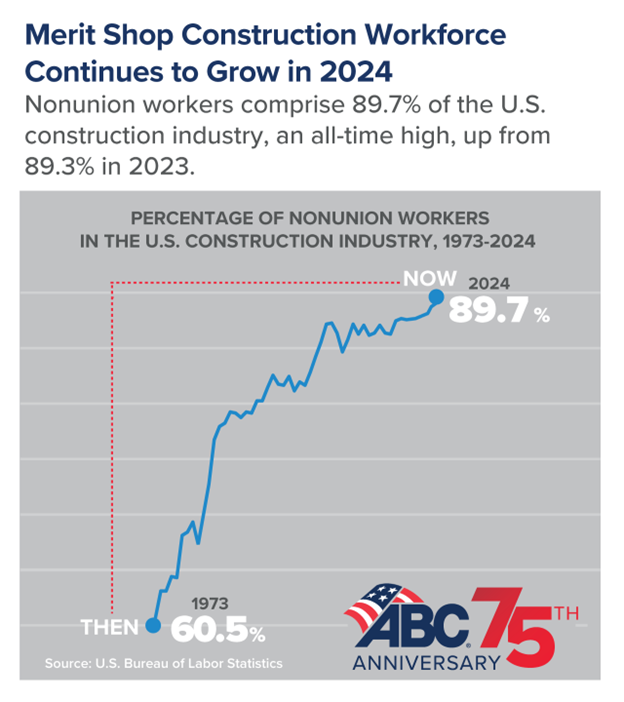

At least 90% of workers in the private construction industry did not belong to a union in 29 states in 2024 and 2023, up from 26 states in 2022 and 24 states in 2021. Nationwide, the U.S. Bureau of Labor Statistics reports that 7,978,000 construction industry workers were not members of a union in 2024, a 12,000-person increase from 7,966,000 workers in 2023. Overall, union membership decreased by 38,000 to 916,000.

“More and more construction workers work for nonunion employers, defying four years of new union-friendly policy schemes advanced by the self-declared most pro-union president in history,” said Ben Brubeck, ABC vice president of regulatory, labor and state affairs. “In contrast, commonsense policies providing opportunities for all of America’s construction workforce are rooted in the ideals of merit and worker choice, which help taxpayers get the best possible infrastructure products at the best possible price.”

A record-high 89.7% of construction workers nationwide are not part of a union, according to the U.S. Bureau of Labor Statistics, up from 89.3% in 2023.

“Workers’ choice to affiliate with unions independent of government interference creates immense value in the marketplace, which is why ABC will continue to oppose government-mandated project labor agreement policies and advocate for all construction workers to choose how to achieve their career dreams and prosper in a safe and healthy environment,” said Brubeck. “ABC urges the Trump administration and the 119th Congress to advance policies that prioritize fair and open competition, preserve worker choice and address the issues that the construction industry faces, including a skilled labor shortage of 439,000 in 2025 alone, widespread regulatory burdens, inflation, high interest rates, expiring tax provisions and other economic challenges.”